Grenzeloos groeien zonder gedoe.

Wij automatiseren btw en EPR voor e-commerce.

Trusted by e-commerce leaders

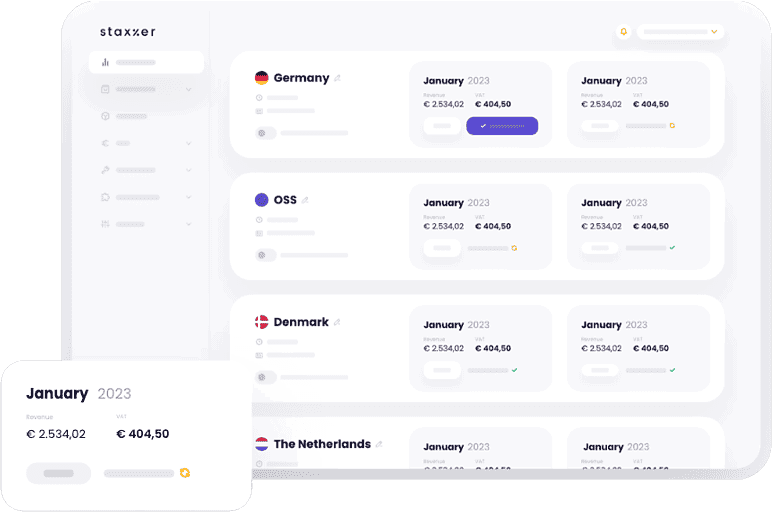

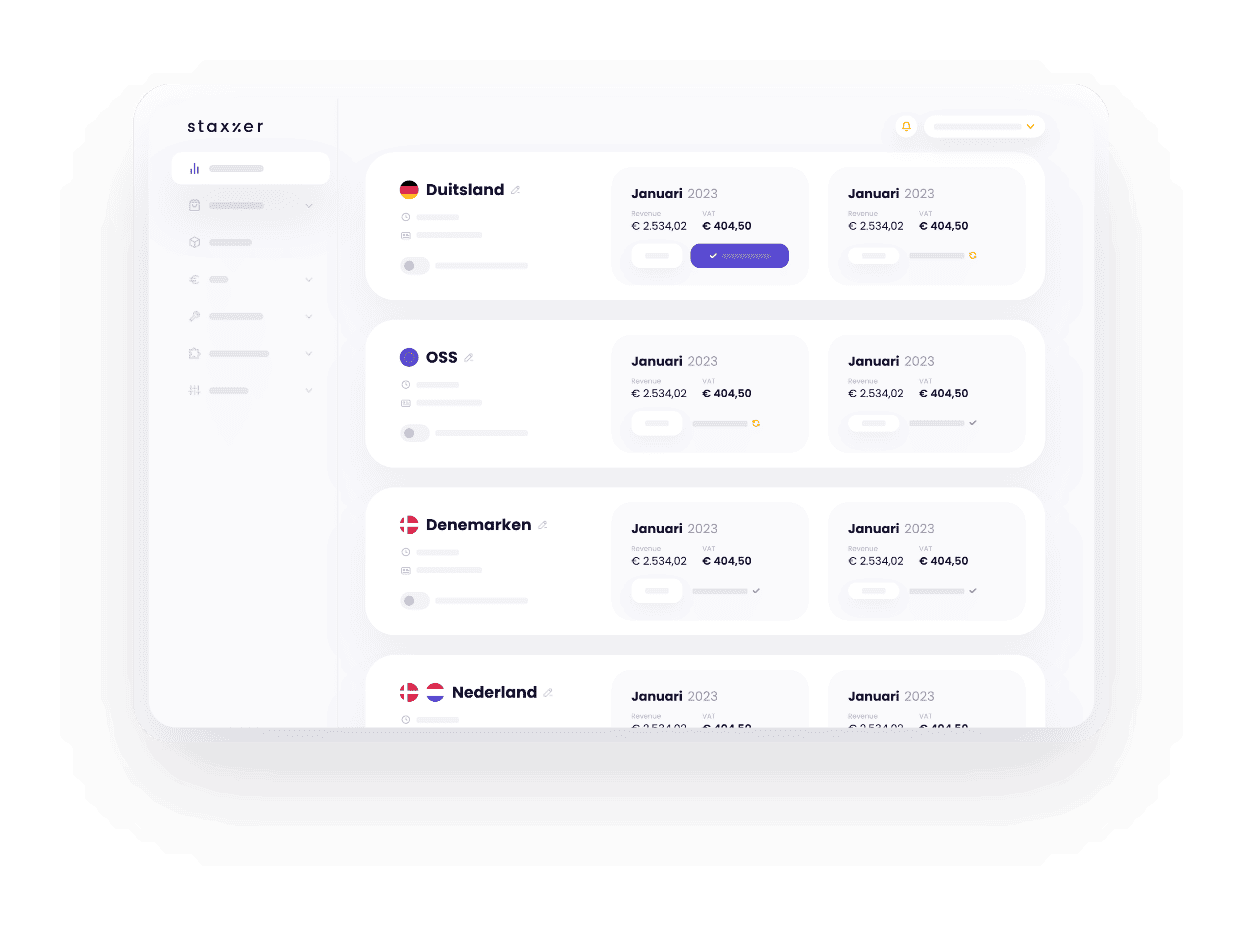

Automatiseer je btw-aangiften

Waar je ook verkoopt in Europa, wij maken het simpel en efficiënt. Met onze eigen software zorgen wij ervoor dat jij als e-commerce verkoper geen tijd meer kwijt bent aan je btw-aangiftes. Koppel al je verkoopkanalen en automatiseer je Europese btw-compliance!

Nieuwe markt veroveren?

Nieuwe markt veroveren? Dan heb je een btw-registratie nodig. Geen probleem, die regelen wij voor je!

- NederlandVanaf €247,-

- DuitslandVanaf €172,-

- DenemarkenVanaf €322,-

Heb je al een btw-registratie? Probeer onze software 30 dagen lang.

Waarom ondernemers kiezen voor Staxxer

Wij berekenen tot op de cent nauwkeurig hoeveel btw je in ieder land bent verschuldigd en verzorgen het aangifteproces van A tot Z. Met Staxxer krijg je meer tijd om te groeien, vrijheid en inzicht. Automatiseer je Europese btw-aangiften nu voor een zorgeloze compliance.

- Altijd snel & menselijk contact

- Korte lijntjes, geen wachttijden

- Altijd specialistische kennis

500+ tevreden klanten

“Staxxer was de enige partij die perfect aansloot bij onze internationale groei-ambities en het oplossen van de Europese OSS btw-administratie.”

Melle Schellekens

founder The Good Roll

“Met Staxxer hebben wij in één oogopslag een overzicht van onze internationale verkopen en bijhorende btw-verplichtingen. De aangifte is met één klik gedaan. Het dashboard is snel, makkelijk en correct. Erbovenop biedt het Staxxer team ook een uitmuntende service.”

Roel Shatorjé

founder MOYU

“Samen sta je sterker! Door onze samenwerking met Staxxer kunnen de e-commerce ondernemers van morgen internationaal verkopen zonder btw-zorgen”

Bas Urlings

founder Plazatalk

“Staxxer was de enige partij die perfect aansloot bij onze internationale groei-ambities en het oplossen van de Europese OSS btw-administratie.”

Melle Schellekens

founder The Good Roll

“Met Staxxer hebben wij in één oogopslag een overzicht van onze internationale verkopen en bijhorende btw-verplichtingen. De aangifte is met één klik gedaan. Het dashboard is snel, makkelijk en correct. Erbovenop biedt het Staxxer team ook een uitmuntende service.”

Roel Schatorjé

founder MOYU

“Samen sta je sterker! Door onze samenwerking met Staxxer kunnen de e-commerce ondernemers van morgen internationaal verkopen zonder btw-zorgen”

Bas Urlings

founder HappySoaps

“Staxxer was de enige partij die perfect aansloot bij onze internationale groei-ambities en het oplossen van de Europese OSS btw-administratie.”

Melle Schellekens

founder The Good Roll

“Met Staxxer hebben wij in één oogopslag een overzicht van onze internationale verkopen en bijhorende btw-verplichtingen. De aangifte is met één klik gedaan. Het dashboard is snel, makkelijk en correct. Erbovenop biedt het Staxxer team ook een uitmuntende service.”

Roel Shatorjé

founder MOYU

“Samen sta je sterker! Door onze samenwerking met Staxxer kunnen de e-commerce ondernemers van morgen internationaal verkopen zonder btw-zorgen”

Bas Urlings

founder Plazatalk

“Staxxer was de enige partij die perfect aansloot bij onze internationale groei-ambities en het oplossen van de Europese OSS btw-administratie.”

Melle Schellekens

founder The Good Roll

“Met Staxxer hebben wij in één oogopslag een overzicht van onze internationale verkopen en bijhorende btw-verplichtingen. De aangifte is met één klik gedaan. Het dashboard is snel, makkelijk en correct. Erbovenop biedt het Staxxer team ook een uitmuntende service.”

Roel Schatorjé

founder MOYU

“Samen sta je sterker! Door onze samenwerking met Staxxer kunnen de e-commerce ondernemers van morgen internationaal verkopen zonder btw-zorgen”

Bas Urlings

founder HappySoaps

Ontvang persoonlijk advies

Heb je een vraag?

Staat die van jou er niet tussen? Geef ons dan een seintje.

Heb jij voorraad opgeslagen in het buitenland, omdat je bijvoorbeeld verkoopt via Amazon FBA of gebruik maakt van een Europees fulfilment center? Dan heb je in dat land een eu btw nummer nodig! Bespaar jezelf het papierwerk en laat ons jouw btw-nummer aanvragen.

Waar is het btw-nummer geldig?

Het btw-nummer kun je gebruiken voor elk zakelijk doeleinde. Bijvoorbeeld bij verkopen via Amazon, Bol.com, Shopify of een ander platform. Het nummer is ook geldig als je lokaal zaken gaat doen waar je een Europees btw-nummer voor nodig hebt!

Als je een btw-registratie in het buitenland hebt, zul je daar ook btw-aangifte moeten doen. Hoe vaak en wanneer dat moet hangt af van het land. Het kan maandelijks zijn, of per kwartaal.

Wij snappen dat je geen zin hebt in alle btw-administratie. Laat het daarom aan ons over: koppel je verkoopaccounts aan Staxcloud, zodat wij altijd accuraat jouw Europese btw-aangifte kunnen doen. Dan ben jij geen tijd meer kwijt aan btw-aangifte!

1 Juli 2021 is de One Stop Shop ingegaan, ook wel het éénloketsysteem genoemd. Verkoop jij jaarlijks voor meer dan €10.000.- over de grens? Via deze nieuwe regeling geef jij in één keer jouw btw aan van alle landen waarin je zakendoet. Als jij al jouw voorraad in Nederland hebt liggen, heb je niet langer een btw-nummer nodig in die andere landen. In de One Stop Shop-aangifte geef jij iedere grensoverschrijdende verkoop binnen de EU aan.

Dat brengt behoorlijk wat rekenwerk met zich mee. Zeker als je via meerdere platformen verkoopt! Daar hebben wij iets op verzonnen: je kunt al je verkoopkanalen (Amazon, Bol.com, Shopify en meer) koppelen aan Staxcloud. Zo heb je altijd alle btw-gegevens bij de hand, en binnen 5 minuten heb jij je One Stop Shop-aangifte geregeld. Staxcloud doet de berekeningen, en onze Staxxers handelen de aangifte verder af. Handig toch?

Wij kunnen in ieder EU-land een btw-registratie voor je regelen, en in ieder EU-land de btw-aangiften voor je doen.

Zie je jouw land niet op onze productpagina staan? Neem dan contact op met support, dan kijken we wat we kunnen betekenen.

Je hebt een btw-nummer nodig wanneer je voorraad opslaat in een ander EU-land of wanneer je over het drempelbedrag van een land gaat. Dit moet je vooral in de gaten houden als je verkoopt via marketplaces, zoals Amazon, Bol.com of Shopify.

Zeker weten of je een btw-nummer nodig hebt? Neem vrijblijvend contact op. Wij kunnen ook een btw-nummer voor je aanvragen.

De One Stop Shop (OSS)-regeling maakt het mogelijk om je buitenlandse verkopen vanaf een Nederlandse voorraad aan te geven in één portaal. Zo heb je niet meer in elk land een btw-registratie nodig, tenzij je daar voorraad aanlegt. Verstuur je jaarlijks voor meer dan €10.000,- naar andere EU-landen? Dan kom je in aanmerking voor de One Stop Shop. Aanmelden voor de One Stop Shop kan via ‘Mijn Belastingdienst Zakelijk’.

Jouw verkopen dien je vervolgens per kwartaal aan te geven in je One Stop Shop-aangifte. Hierin geef je aan hoeveel btw jij in ieder Europees land moet afdragen, afhankelijk van het lokale btw-percentage van jouw producten.

Wanneer je jaarlijks meer dan €10.000,- over de grens verstuurt, kun je gebruik maken van de One Stop Shop. Registreren is niet verplicht, maar het maakt het wel een heel stuk makkelijker. Je kunt namelijk al je verkopen aangeven in één portaal, en hebt geen buitenlandse btw-nummers meer nodig als je daar geen voorraad hebt liggen.

Wanneer jij je btw aangeeft via de One Stop Shop, maar ook voorraad in een ander EU-land hebt liggen, heb jij daar nog steeds een btw-nummer nodig. De One Stop Shop is vooral bedoeld voor marketplace-verkopers die vanuit hun (bijvoorbeeld) Nederlandse voorraad naar andere landen verzenden. Wil jij tijd besparen en ons je One Stop Shop-aangifte laten doen?

Als verkoper op Amazon heb jij de keuze om voor Amazon FBA te kiezen: zo verspreid je in één handomdraai jouw voorraad over de Europese fulfilment centers van Amazon. Een goede optie als je flink wil internationaliseren! Met FBA zijn jouw producten bovendien sneller in huis bij de klant, en heb je meer kans om de Buy Box te winnen.

Als je kiest voor Amazon Pan European FBA, dan verdeelt Amazon jouw voorraad over verschillende landen. Omdat je daar voorraad aanlegt, heb je een btw-nummer nodig in ieder van die landen. Om het wat makkelijker te maken voor jou, hebben wij die landen in één pakket gestopt. Je krijgt een btw-nummer voor ieder Pan-Europees land, zodat je meteen aan de slag kan met verkopen. In ons pakket zit een:

- Duits btw-nummer

- Pools btw-nummer

- Tsjechisch btw-nummer

- Frans btw-nummer

- Spaans btw-nummer

- Italiaans btw-nummer

Heb je alle btw-nummers binnen? Dan kunnen wij voor slechts €395,- per maand ervoor zorgen dat jij btw-compliant blijft in deze landen. Zo heb jij geen omkijken meer naar je btw, en houd je meer tijd over voor jouw business.

We hopen het natuurlijk niet, maar je kunt altijd je abonnement beëindigen. Bij Staxxer zit je namelijk nergens aan vast, maar betaal je simpelweg per het gedane werk. Zo weet jij altijd waar je aan toe bent.

Je kunt via support@staxxer.com laten weten dat je wilt opzeggen.

Staxxers zijn echte mensen. Wij spreken jouw taal en je mag altijd vragen wat je wilt.

Deze prijzen worden gebruikt voor het berekenen van goederenverplaatsing. Dat is een prijs die je betaalt om een product te kopen, hier kun je bijvoorbeeld ook de verzendkosten en andere kosten bij rekenen.

Wholesale prices zijn inkoopprijzen. Deze prijzen worden onder andere gebruikt voor de btw-berekeningen van goederenverplaatsingen. Een wholesale price is de prijs die je betaalt om een product te kopen. Je kunt er ook nog andere kosten bijrekenen (zoals verzendkosten). Daarom zijn wholesale prices niet hetzelfde als inkoopprijzen.

We hebben de wholesale prices nodig om de btw bij goederenverplaatsingen te berekenen. Wanneer er bijvoorbeeld producten vanuit Nederlandse voorraad naar een Duitse opslag verplaatsen, dan moet dat aangegeven worden in je btw-aangifte. Deze goederen hebben een waarde, de wholesale price. Deze geef je op in je ICP-opgave.

Een tarief is een belasting op geïmporteerde goederen en het tariefnummer, ook wel een tariefcode of HS-code genoemd, geeft de douanebeambtenaren meer informatie over wat voor soort artikel er wordt geïmporteerd. De standaardcode is een zescijferig nummer, maar sommige landen hebben codes van 8 of 10 cijfers.

Bekend van

Meer leren over btw?

Dat kan! Lees onze nieuwste artikelen hier: