Amazon is niet meer weg te denken uit de e-commerce: het is één van de grootste marketplaces ter wereld. Niet gek dat veel e-commerce verkopers ervoor kiezen hun producten via Amazon te verkopen om te groeien. En nu Amazon zich steeds verder uitbreidt in Europa, is het zeker het overwegen waard.

Om te verkopen op Amazon heb je natuurlijk een Amazon Seller account nodig – in dit artikel zullen we door deze stappen heen lopen. Vervolgens kun je kiezen of je zelf de opslag en transport wilt regelen (Fulfilment by Merchant), of dat Amazon het voor je regelt (Fulfilment by Amazon).

Dit artikel zal ingaan op wat FBA precies is, wat de voordelen zijn, en welke kosten eraan zijn verbonden. Maar we zullen bij het begin beginnen:

Hoe wordt je Amazon verkoper?

Je moet een aantal dingen regelen voordat je kan verkopen op Amazon. Dit betreft vooral het aanmaken van een account. De stappen die nodig zijn om dit te doen zijn hieronder voor je op een rijtje gezet.

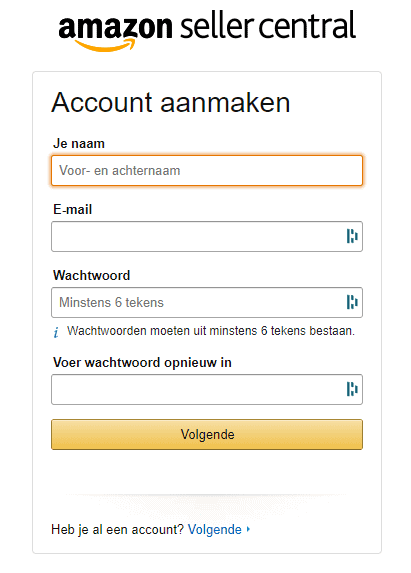

- Je meldt je aan als verkoper via deze link.

- Vervolgens maak je een Amazon account met de door jou gekozen inloggegevens.

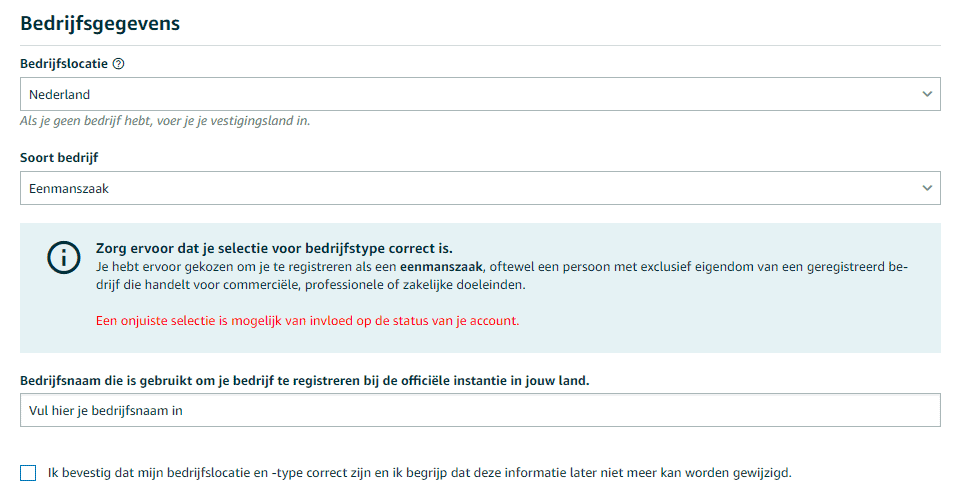

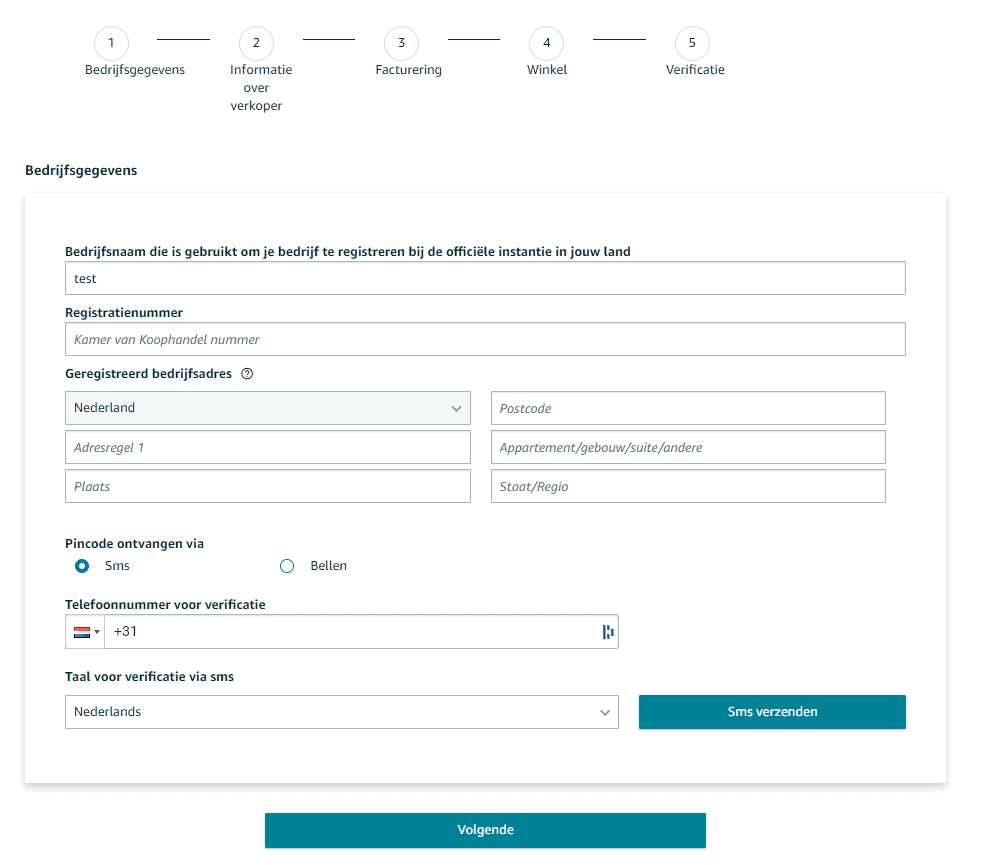

- Vul je bedrijfsgegevens in.

- Vul je persoonlijke gegevens in. Let op: Amazon herkent telefoonnummers die eerder gebruikt zijn in een Amazon-omgeving, bijvoorbeeld voor een privé-account (Amazon Prime Video, bijvoorbeeld). Een eerder gebruikte email voor een dienst van Amazon kun je dus niet gebruiken.

- Vul je creditcard gegevens in voor de betaling aan Amazon. Later komen we terug op de kosten van Amazon FBA.

- Vervolgens moet je een winkelnaam aan je account toevoegen. Deze hoeft niet gelijk te zijn aan je bedrijfsnaam (op je KVK-registratie). Deze naam geldt dus specifiek voor het platform van Amazon.

- Zorg er voor dat je account goed beveiligd is: schakel een tweestapsverificatie in. Dit kan via een telefoonnummer of Authenticator app.

Na het doorlopen van deze stappen heb je de mogelijkheid om je ‘Amazon Seller Central’ in te richten. Hier kan je alles bijhouden met betrekking tot je producten en je Amazon winkel: van je voorraad tot het aantal verkopen tot de communicatie met de kopers.

Wat is Amazon FBA (Fulfilment by Amazon)?

Amazon FBA is een logistiek systeem om verkopers te helpen met hun (internationale) verkopen. Amazon regelt de opslag en de logistiek: daar hoef jij dus niet meer over na te denken. Het neemt dus veel uit handen. De tijd die je hiermee vrijmaakt, kun je weer gebruiken voor het uitbreiden van je bedrijf op andere manieren.

Vanaf het moment dat je een Amazon account hebt aangemaakt kun je gebruik gaan maken van ‘Fulfilment by Amazon’. Hiermee kan je je producten opslaan in een Amazon fulfilment center. In Europa bevinden deze zich in Duitsland, Spanje, Polen, Zweden, Tsjechië, Italië, Engeland, België en Nederland.

Hoe werkt Amazon FBA?

In een notendop: jij selecteert welke producten je in via welke FBA centers wilt versturen. Wat je dan moet doen, is ervoor zorgen dat je voorraad naar één van die fulfilment centra gaat. Vanuit daar doet Amazon de rest. Amazon pakt, verpakt en verzendt jouw producten en handelt ook de klantenservice en retourzendingen af.

Jouw voorraad wordt verdeeld over de geselecteerde fulfilment centra’s. Op basis van de locatie van de klant, wordt jouw product verzonden uit het center dat het dichtstbij is. Zo zijn pakketjes nog sneller bij de klant in huis!

Voordelen van Amazon FBA

Door te verkopen met Amazon FBA kun je genieten van een aantal voordelen. De grootste voordelen op ene rij:

- Je producten zijn zichtbaarder op Amazon;

- Je hebt (meer kans op) de Buy Box, dus op conversieverhoging;

- Je kan gebruik maken van de Amazon Prime verzendservice: pakketjes zijn dus sneller in huis;

- Samengevat: de kans is groot dat je aantal verkopen toeneemt.

Wat is de Buy Box eigenlijk?

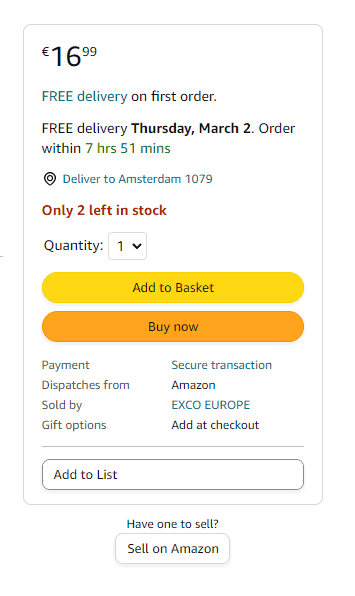

De Buy Box op Amazon is een belangrijk onderdeel van de productdetailpagina waar klanten direct het product kunnen kopen. Het vakje bevindt zich aan de rechterkant van de pagina en bevat de knop “In winkelwagen” of “Nu kopen” (voorbeeld hieronder).

Aangezien meerdere verkopers hetzelfde product verkopen, maakt Amazon gebruik van een algoritme om te bepalen welke verkoper in de Buy Box wordt weergegeven op basis van verschillende factoren. Hieronder staan vijf tips om de kans op weergave van de buy-box te vergroten:

- Zorg voor positieve reviews: Amazon hecht veel waarde aan de kwaliteit van de verkoper en klantenservice. Zorg ervoor dat je positieve beoordelingen hebt en dat je snel en efficiënt problemen oplost.

- Bied concurrerende prijzen: het algoritme van Amazon houdt rekening met de prijs van het product bij het bepalen van de winnende verkoper voor de Buy Box. Zorg ervoor dat je prijzen concurrerend zijn en niet te hoog in vergelijking met andere verkopers.

- Verzend sneller: Amazon geeft de voorkeur aan verkopers die snelle verzending bieden. Als je ervoor kunt zorgen dat je producten snel worden verzonden, heb je meer kans om in de buy-box te worden weergegeven. Hier heb je een streepje voor met FBA, dus!

- Vermijd beschadigde producten en retouren: als je veel beschadigde producten en retouren hebt, kan dit je prestaties op Amazon negatief beïnvloeden. Zorg er dus voor dat je producten van goede kwaliteit zijn en dat je klanten tevreden zijn.

- Bied goede klantenservice: misschien een open deur, maar goede klantenservice is een belangrijke factor voor het winnen van de Buy Box. Zorg ervoor dat je vragen snel en professioneel beantwoordt en dat je klachten snel oplost om een goede indruk te maken op Amazon (en je klanten).

Waarom gebruik maken van de Amazon Prime verzendservice?

Als je verkoopt via Amazon, kan het gebruik van de Amazon Prime verzendservice verschillende voordelen bieden. Amazon Prime is een abonnementsservice die door miljoenen klanten wordt gebruikt en die ze in staat stelt om te profiteren van gratis snelle verzending, gratis retourzendingen en andere voordelen, zoals toegang tot streaming van video- en muziekcontent.

Hier zijn enkele redenen waarom je als verkoper gebruik zou moeten maken van de Amazon Prime verzendservice:

- Verhoogde zichtbaarheid: producten die worden aangeboden met Amazon Prime verzending, worden vaak hoger gerangschikt in zoekresultaten en hebben een betere kans om in de Buy Box te worden weergegeven. Dit betekent dat ze meer zichtbaarheid hebben en een hogere kans hebben om te worden verkocht.

- Betere klanttevredenheid: Amazon Prime-leden hebben hoge verwachtingen als het gaat om verzending en retourzendingen. Door gebruik te maken van de Amazon Prime verzendservice, kun je snelle en gratis verzending bieden aan klanten, wat hun tevredenheid verhoogt en je beoordelingen kan verbeteren.

- Hogere conversieratio’s: omdat Amazon Prime-leden vaak op zoek zijn naar producten met snelle en gratis verzending, hebben producten die worden aangeboden met Amazon Prime verzending hogere conversieratio’s dan producten die dat niet doen.

- Meer kans op herhaalaankopen: klanten die tevreden zijn met de verzendservice van Amazon Prime hebben meer kans om in de toekomst opnieuw bij jou te kopen, waardoor je als verkoper een loyale klantenkring kunt opbouwen.

Het is echter belangrijk om op te merken dat het gebruik van de Amazon Prime verzendservice extra kosten met zich meebrengt, zoals fulfilment- en opslagkosten. Het is daarom belangrijk om de kosten en baten zorgvuldig af te wegen voordat je beslist of de Amazon Prime verzendservice geschikt is voor jouw bedrijf.

Hoe registreer je je voor Amazon FBA?

Genoeg voordelen dus. Maar, dan moet je wel je Amazon account goed hebben ingesteld. Het instellen van Amazon FBA gaat via ‘Seller Central’, waar we het ook al eerder over hadden. Je hebt toegang door in te loggen met je Amazon account. In deze persoonlijke omgeving kan je per product aangeven of je het wil verkopen met behulp van Amazon FBA.

Als je ‘Seller Central’ voor je hebt, ga je naar het kopje ‘Voorraad beheren’. Hier kan je je listings selecteren en vervolgens wijzigen naar Fulfilled by Amazon. Op dit punt kan je een land kiezen waar je je voorraad heen wilt sturen. Vervolgens bereid je je zending voor en kies je een verzendmethode. De verzendmethode betreft de manier waarop je je producten verzend naar het door jou gekozen Amazon fulfilment center.

Er zijn best wat eisen waaraan je pakketjes moeten voldoen. Zeker als het aankomt op voorbereiding en etikettering voor het Amazon fulfillment center. Mocht dit niet goed gaan is het mogelijk dat Amazon je zendingen afkeurt. Het is belangrijk om duidelijk te hebben wat er van je wordt verwacht. Zo weet je zeker dat alles goed gaat. Hier lees je daar meer over.

Btw-aangiftes en Btw-registraties

Btw-verplichtingen zijn een ander ding waarmee rekening gehouden moet worden. Zo weet je zeker dat je producten niet worden geweigerd bij aankomst in een van de fulfilment centers. Btw-verplichtingen kunnen erg variëren per bedrijf, en per land.

De vuistregel luidt als volgt: zodra je voorraad neerlegt in een ander EU-land, wordt je daar btw-plichtig. Dat betekent dat je er een btw-nummer nodig hebt en dat je er btw-aangiften moet doen. Wil je verkopen via FBA? Dan gaat Amazon jouw voorraad verdelen over de geselecteerde fulfilment centers, maar niet jouw btw-compliance in de gaten houden. Hier ben je als verkoper zelf verantwoordelijk voor.

Als je gebruik maakt van verschillende Amazon fulfilment centers kan je het beste een PAN European btw-nummer aanvragen. Het aanvragen van verschillende nummers kan een tijdrovende taak zijn, omdat er verschillende overheidsinstanties bij betrokken zijn. Veel e-commerce ondernemers kiezen er daarom voor om het proces te automatiseren. Onderneem dus op tijd actie!

Kosten van Amazon FBA

Fulfilment by Amazon komt wel met een prijskaartje. Het exacte bedrag hangt af van een aantal factoren, bijvoorbeeld hoeveel je verkoopt en hoe gemakkelijk je producten te vervoeren zijn. De kosten van Amazon FBA zijn onder te verdelen in een aantal categorieën.

- Standaard verkoopcommissie: dit is de algemene commissie die Amazon telt over elke verkoop. Deze varieert tussen 10% en 15% van je bruto-omzet per verkoop.

- Maandelijkse kosten Amazon FBA: om gebruik te maken van Amazon FBA betaal je maandelijks €39,- (excl. btw).

- FBA vergoedingen: op basis van de standaard FBA opslag en fulfilmentkosten. De kosten hangen af van het producttype, de afmetingen, het gewicht en hoeveel producten je op voorraad legt.

- Voorraadkosten: naast maandelijkse (FBA) opslagkosten kunnen er ook andere kosten in rekening worden gebracht, zoals kosten voor het langdurig opslaan van voorraad of verwijdering van producten.

De totale kosten zijn dus erg variabel. Bijvoorbeeld, de voorraadkosten worden flink hoger als je producten langer dan een jaar bij Amazon liggen. Breng dus van te voren in kaart hoeveel je ongeveer moet betalen. Zo kom je niet voor verrassingen te staan.

Denk aan je btw!

Want als je je (internationale) btw niet op orde hebt, kun je niet beginnen met verkopen via Amazon FBA. Staxxer neemt dit graag voor je uit handen. Onze experts bevinden zich in alle EU-landen waar je mogelijk een lokaal btw-nummer nodig hebt. Ze zijn bekend met de lokale belastingstructuur en kunnen je helpen in je eigen taal. Zo kan jij gewoon gebruik maken van Amazon FBA zonder extra kopzorgen.

Benieuwd wat Staxxer voor jou kan betekenen, ook als je al een boekhouder hebt? Verken onze opties of kom even hoi zeggen!

Nb: We hebben onze services uitgebreid! Voortaan kun je ook bij Staxxer terecht voor EPR-services. Neem contact met ons op voor de opties.

Liever een samenvatting?

Dan kun je deze video kijken, waarin btw-expert Joke uitlegt hoe het zit met btw en Amazon FBA. Als je na het kijken van de video vragen hebt, aarzel dan niet om contact met ons op te nemen voor (gratis) advies!