- Products

- EU VAT declaration

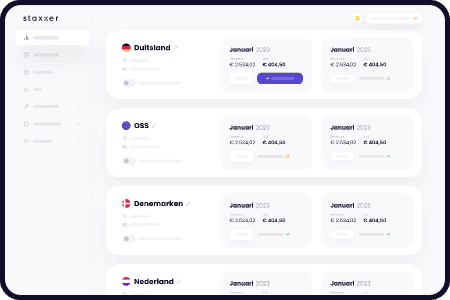

Automate your VAT filings with Staxxer

We help e-commerce entrepreneurs sell internationally more easily by optimizing and automating the VAT return process. Then you won’t have to worry anymore during your international growth.

What is it?

Your VAT returns taken care of from A to Z

European VAT regulations are complex enough. So let Staxxer help and automate your VAT returns.

We can’t make it any simpler: with our software you can see in one printout how much VAT you owe per EU country. Down to the penny.

These companies trust Staxxer

How it works

Customized, personal analysis

Talk to one of our VAT experts to make sure all your VAT issues are taken care of properly.

Register your VAT number

We can take care of the application itself and the paperwork!

Connect your sales channels

View the VAT due in each country in a single overview.

That's all!

Your personal representative will keep you informed about your to do’s.

Peace of mind

Staxxer provides clarity and control

Yes indeed, but that can be quite a challenge.

For example, there are differences in VAT rates and language barriers. In fact, you always file your VAT return through the local tax office, in the local language. This can lead to incorrect VAT returns, which in turn can lead to fines. Not to mention the time it takes to figure it all out.

You’d rather have that automated, wouldn’t you?

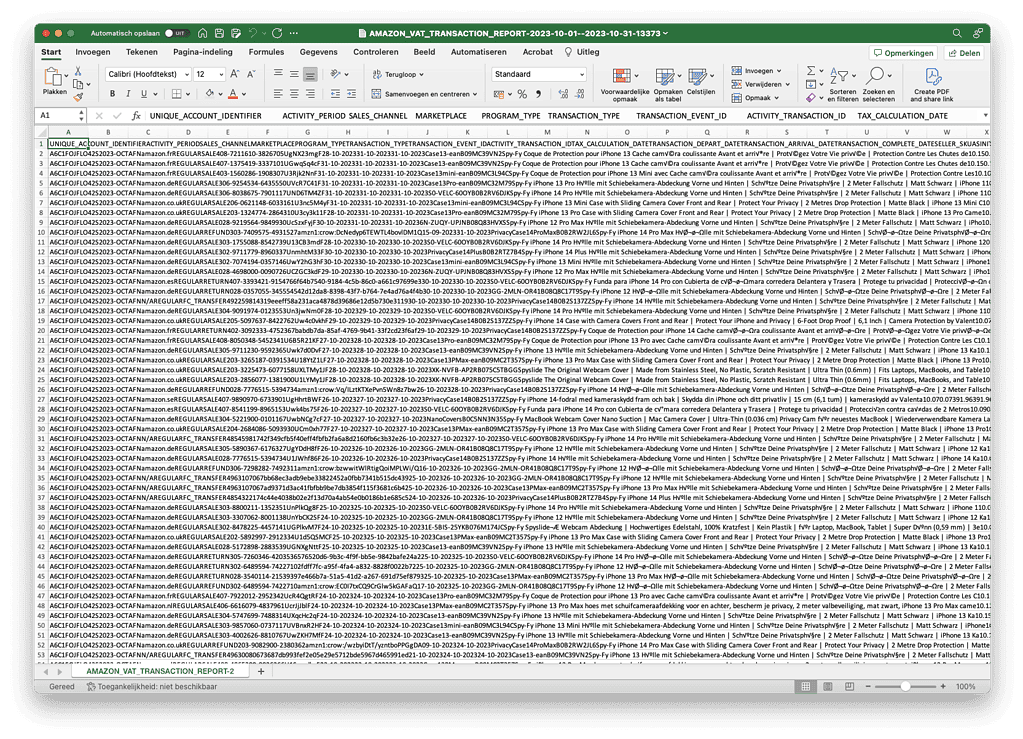

Excel

Still struggling with 5 cluttered Excel sheets? We know how frustrating it can be.

- Chaotic

- Time-consuming manual calculations

- Self-managed VAT filing

vs

Dashboard

Our software provides a single report showing how much VAT you owe per EU country.

- Clear at one glance

- Eliminates manual calculations

- Automated VAT declaration

Automate your VAT Filings.

Wherever you sell in Europe, we make it simple and efficient. Our software ensures that as an e-commerce seller, you no longer need to spend time on your VAT filings. Link all your sales channels and automate your European VAT compliance.

Why entrepreneurs choose Staxxer

We calculate your VAT down to the last cent in each country and handle the entire filing process from A to Z. With Staxxer, you regain your freedom and win back more time to grow. Automate your European VAT now for worry-free compliance.

Do you have a question?

If yours is not listed, give us a call.

If you have a VAT registration abroad, you will also have to file VAT returns there. How often and when to do so, depends on the country. It can be monthly, or quarterly.

We understand that you don’t feel like doing all the VAT administration. So leave it to us: link your sales accounts to Staxcloud, so we can always accurately file your European VAT return. Then you won’t spend any more time on VAT returns.

We can arrange VAT registration for you in any EU country, and do VAT returns for you in any EU country.

Don’t see your country listed on our product page? If so, contact support and we’ll see what we can do.

The One Stop Shop (OSS) arrangement allows you to declare your cross-border sales in one portal. For example, you no longer need VAT registration in every country unless you stock up there. Do you sell more than €10,000,- annually to other EU countries? Then you qualify for the One Stop Shop. Sign up for the One Stop Shop can be done through “My Tax Business”.

Your sales should then be reported quarterly in your One Stop Shop declaration. Here you specify how much VAT you have to pay in each European country, depending on the local VAT rate of your products.

As a seller on Amazon, you have the choice to opt for Amazon FBA: this way, you distribute your inventory across Amazon’s European fulfillment centers in a snap. A good option if you want to go international! With FBA, your products also get to customers faster, and you have a better chance of winning the Buy Box.

If you choose Amazon Pan European FBA, Amazon will distribute your inventory across several countries. Because you’re stocking up there, you need a VAT number in each of those countries. To make it a little easier for you, we’ve put those countries into one package. You get a VAT number for each Pan-European country, so you can start selling right away. Our package includes one:

- German VAT number

- Polish VAT number

- Czech VAT number

- French VAT number

- Spanish VAT number

- Italian VAT number

Are all the VAT numbers in? Then we can also make sure that you remain VAT-compliant in these countries. That way, you no longer have to worry about your VAT, and you have more time left over to grow your business.

Staxxers are real people. We speak your language and you can always ask whatever you want.