German VAT number

Planning to sell through Amazon FBA or Zalando in Germany? A German VAT number is crucial.

On this page, we will give you all the information needed concerning the process, including handling VAT returns, issuing invoices, and managing the supply of goods.

Do you want to enter new international markets worry-free? Then let us apply for your VAT number, we’ll take care of the administrative hassle!

- Requested within 24 hours

- Transparent pricing

- Fast and personal support

When should I register for a German VAT identification number?

You need a VAT number in Germany if:

- You purchase goods, stock them locally, and then resell them in Germany.

- You buy goods in Germany and then deliver them to other EU countries or export them to countries outside the EU, a process involving sales tax.

- You export excise goods (alcoholic products, tobacco products, and/or mineral oils).

- You import goods into Germany from outside the EU. Then you sell them within the EU.

- You sell products via Amazon.*

- You move your own goods to Germany (notional intra-community delivery).

*Amazon.de requires a VAT registration number. When selling products online via the Pan-European FBA program, you must immediately register for VAT in various EU countries, including obtaining a German VAT number through the German tax office.

On average 10-12 weeks

8-12 weeks

6-8 weeks

On average 4-6 weeks

2-4 weeks

Amazon FBA

How can you apply for VAT registration?

A VAT number (UstId.Nr) is your fiscal identification in Germany. You need this number to legally sell products through Amazon FBA from a German distribution center. Without this number, your Amazon.de account will be blocked immediately, so it’s crucial to get this sorted before you start selling.

The application for foreign businesses with the German tax office requires some preparation. First, you need to obtain a tax number, Steuernummer, from the local Finanzamt Kleve in Germany. With that number, you can then apply for your UstId.Nr. This process can be done online, via the Bundeszentralamt für Steuern.

Would you rather hand this task over? Contact us and we can submit the application within 24 hours.

Amazon FBA in Germany

To use Fulfillment by Amazon (FBA), you will need a German VAT number. If you do not, your Amazon account will be directly blocked. Amazon.de requires a Steuernummer and a German VAT number (UstId.Nr) for selling through Amazon FBA from the German distribution center.

Once you have that, you can sign up for Amazon FBA, and often your products will be with the customer the next day.

What do you get when you apply for a German VAT number?

Applying for a German VAT number includes two documents:

Steuernummer: The German VAT number to be applied for at the tax office. For example: DE0123456789;

Umsatzsteuer-Identifikationsnummer (USt-IdNr.): German Tax ID.

If we apply for the German VAT number for you, we will arrange these documents for you.

Securing a VAT ID not only allows you to transact within the EU but also to comply with local tax laws, especially in the context of VAT returns. These returns are crucial as they detail your taxable transactions and help calculate the tax you owe or can reclaim.

Moreover, when you supply goods, each sale must be accompanied by an invoice that prominently displays your VAT number. This is not just a formal requirement but a necessary part of your financial documentation, ensuring transparency and correctness in your tax reports.

How does the VAT process work?

Apply for your VAT number with Staxxer

Dispatched within 24 hours.

Leave the paperwork to us.

We've got you covered.

Done, you have a VAT number!

Ready for a smooth international start.

Co-owner of Respiflex Healthcare

Founder of Happy Towels

Founder of Daedalos

Founder of Belieff

Founder of Maicura

Founder of Pedal Plate

Founder of Breaking Limits

Why Staxxer?

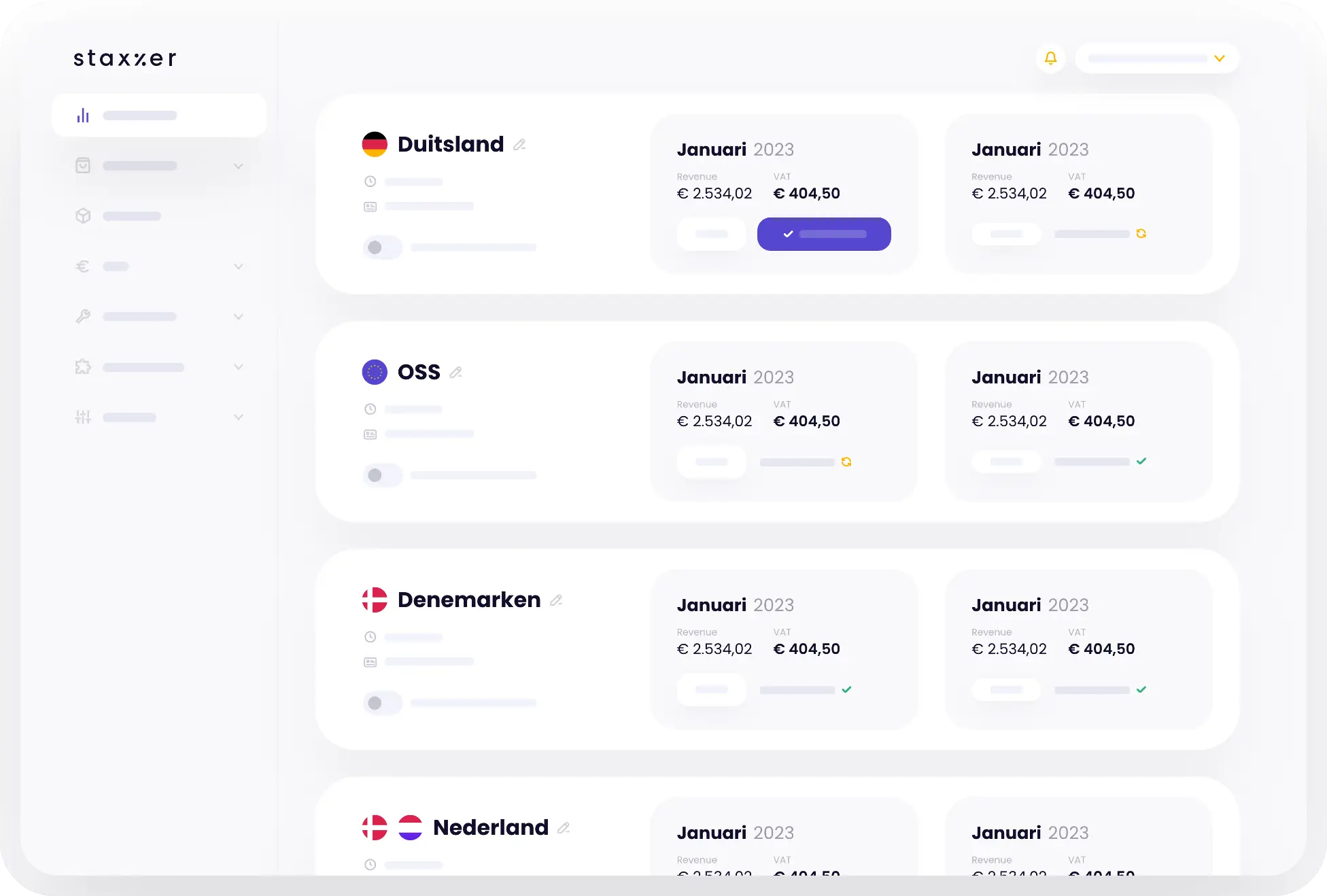

Simple, efficient, and always up-to-date: With Staxxer, you’re always one step ahead.

Connected to your sales channels.

All VAT flows in one place.

Always personal support.

We speak your language.

VAT compliant & worry-free.

Wherever you sell in Europe.

VAT filings in Germany

Staxxer brings clarity and control to your financial operations. True, managing VAT can be daunting.

Consider the varying VAT rates and language hurdles. Typically, you must file your VAT returns with the local tax office, in the local language. This can easily result in errors in your VAT filings, potentially leading to penalties. Plus, think about the time it takes to navigate all these details.

Wouldn’t you prefer to have all this automated?

Do you have a question?

If yours isn’t listed, give us a call.

What does a German VAT number look like?

A German VAT number looks like this: DE followed by nine digits, for example, DE123456789.

What is a UID number in Germany?

UID is another term for the VAT number in Germany, known as “Umsatzsteuer-Identifikationsnummer” (USt-IdNr.). It’s used for tax purposes to identify a business entity within the European Union.

What is a Steuernummer?

A Steuernummer is a tax number issued by local tax offices in Germany for tax processing purposes. It’s used primarily for income tax returns and other tax-related documents. This number is different from the VAT number and is specific to each tax office.

How can I check a German VAT number?

You can verify a German VAT number online through the European Commission’s VAT Information Exchange System (VIES) on their official website. This tool allows you to check if a VAT number is valid and registered for cross-border transactions within the EU.

Can I do transactions in other member states in the EU with a VAT number from Germany?

Yes, you can use a German VAT number to do transactions in other member states of the EU. Having a German VAT number allows you to engage in cross-border transactions within the EU, such as buying and selling goods, providing services, and moving goods between EU countries. However, it’s essential to comply with the VAT reporting requirements in each member state where you conduct transactions. This might involve registering for VAT in those countries depending on the volume of your transactions and the nature of your business activities. Additionally, for certain types of transactions, like distance selling to consumers in other EU countries, you may need to register for VAT in the destination country if your sales exceed the distance selling thresholds set by that country.