Belasting toegevoegde waarde, of btw, is de belasting die wordt geheven over de verkoop van goederen en diensten. De consument die een dienst of product van jou koopt, betaalt de btw. Zodra je een product of service koopt, komt er dus btw bij kijken. Het principe van btw is in heel Europa hetzelfde. Je zou het dus kunnen zien als een algemene, Europese verbruiksbelasting.

In artikel zul je vinden hoe het zit met btw-aangiftes als e-commerce ondernemer, de nieuwe btw-regels uit 2021, hoe je btw-aangifte doet, maar ook waar je rekening mee moet houden als e-commerce verkoper.

Btw in e-commerce en nieuwe btw-regels in 2021

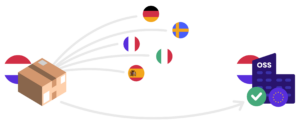

Het kan zomaar zijn dat je als e-commerce ondernemer verkoopt in meerdere EU-lidstaten. In dat geval krijg je te maken met verschillende btw-wetgevingen en -aangiftes. Btw-aangifte doen als ondernemer kost op deze manier veel tijd, zeker als je volledig btw-compliant wil zijn.

De afgelopen jaren is het aantal afstandsverkopen tussen EU-landen sterk toegenomen. In 2021 zijn er daarom nieuwe btw-regels ingevoerd. Maar, wat voor gevolgen heeft dit op jouw btw-aangiftes?

Nieuwe btw-regels 2021

De nieuwe btw-regels zijn vanaf 2021 ingegaan, maar de plannen lagen al in 2017 op tafel. Het waren best wel wat veranderingen, waardoor het aardig wat tijd kostte het nieuwe beleid te implementeren.

Er zijn een paar belangrijke veranderingen doorgevoerd met de nieuwe btw-regels van 2021. Één van de belangrijkste veranderingen is bijvoorbeeld de implementatie van de EU-brede drempelwaarde van 10.000 euro.

Als je totale afstandsverkopen boven deze waarde uitkomen, moet je de btw-tarieven van het bestemmingsland aanhouden. Dit wordt ook wel het bestemmingsbeginsel genoemd. Je krijgt een uitzondering als je onder de drempelwaarde blijft. In dat geval kan je er voor kiezen om gebruik te maken van je lokale btw-tarieven.

De veranderingen zijn in het leven geroepen om e-commerce verkopers te helpen. Het bevordert de internationale marktwerking tussen bedrijven van verschillende groottes. Ook hebben de veranderingen ervoor gezorgd dat btw-verplichtingen minder kosten en dat het minder complex is. Daarnaast hebben EU-lidstaten minder verlies van inkomsten. Het nieuwe systeem kreeg de naam het éénloketsysteem, ook wel de One Stop Shop.

Hoe werkt het éénloketsysteem (One Stop Shop)?

De One Stop Shop voegt al je btw-aangiftes uit verschillende EU lidstaten samen. De Europese lidstaat waar je bedrijf is geregistreerd, is het land die de aangifte regelt. Je hebt dus maar één enkele btw-aangifte nodig voor al je afstandsverkopen.

De One Stop Shop kent drie verschillende regelingen. Je bedrijfsmodel bepaalt welke regeling op jou van toepassing is. Voor nu zullen we de ‘Unieregeling’ en de ‘niet-Unieregeling’ van de One Stop Shop bespreken.

De ‘Unieregeling’ van de One Stop Shop

Als eerste de ‘Unieregeling’: deze gebruik je als je bedrijf is gevestigd in een van de lidstaten van de EU. De One Stop Shop-aangifte doe je in het land waar je bedrijf is gevestigd. Je bent een belastbaar verkoper onder deze regeling wanneer je goederen verkoopt:

- via een online marktplaats (zoals Amazon of Bol.com),

- tussen verschillende plaatsen binnen de EU, en

- naar personen die niet belastingplichtig zijn.

De ‘niet-Unieregeling’ van de One Stop Shop

Het kan ook zo zijn dat je verkoopt aan verschillende EU landen, maar zelf niet in een lidstaat bent gevestigd. In dit geval maak je gebruik van de ‘niet-Unieregeling’.

In principe zijn er weinig veranderingen. Het enige verschil is dat je bedrijf niet binnen de EU is gevestigd. Maar, je bent wel belastingplichtig. Dit komt omdat je verkoopt aan verschillende EU-lidstaten.

Je kan in dit geval zelf een EU lidstaat kiezen om je bedrijf te registreren voor de ‘niet-Unieregeling’. Zodra je bent geregistreerd zal de EU lidstaat waarmee je je identificeert een persoonlijk One Stop Shop btw-nummer genereren. Deze kan je gebruiken voor al je aangiftes.

Hoe doe je btw-aangifte?

Als e-commerce verkoper zijn er meerdere opties met betrekking tot je btw-aangifte. De One Stop Shop kan je btw-aangifte gemakkelijker maken. Het is echter niet verplicht om deze te gebruiken.

Het kan ook zo zijn dat je verplicht bent om een lokaal btw-nummer te hebben. Dit is vaak het geval als je gebruik maakt van de ‘Fulfilment by Amazon‘-regeling. Afhankelijk van je situatie moet je misschien verschillende lokale btw-nummers hebben. Dit is bijvoorbeeld nodig in landen waar je producten opslaat.

Hoe doe je One Stop Shop-aangifte?

Wanneer doe je btw-aangifte? Aangifte voor de One Stop Shop doe je één keer per kwartaal. Dit doe je via het online portaal van de lokale belastingdienst. Er zijn een aantal andere regels die ook betrekking hebben op je One Stop Shop btw-aangifte. Deze relateren aan de lidstaat waarin je bent geregistreerd.

De lidstaat waar je een registratie hebt vraagt je om alle verkoopdetails. Dit betreft je verkopen aan andere EU-lidstaten. Vervolgens gaat de belastingdienst aan de slag. Het brengt in kaart hoeveel btw je in ieder land moet betalen. Daarna krijg je een persoonlijk btw-nummer die je gebruikt om het volledige bedrag over te maken. Zodra de betaling is ontvangen door de lokale belastingdienst verdelen zij het bedrag over de verschillende lidstaten. Precies weten hoe het in z’n werk gaat? Hier leggen we het OSS-aangifteproces stap voor stap uit.

Hoe doe je btw-aangifte met verschillende lokale registraties?

Maar, je kan er dus ook voor kiezen om verschillende lokale registraties te hebben. Daarnaast kan het zijn dat je producten opslaat in een ander land: een land waar je geen One Stop Shop registratie hebt. In dat geval is het verplicht om een lokaal btw-nummer te hebben in het land waar je je producten opslaat.

Lokale registraties leiden over het algemeen tot meer administratie. Daarnaast moet je ook rekening houden met de infrastructuur en wetgeving van de belastingsystemen in verschillende landen. Hoewel het wat meer werk kan kosten, kan het nog steeds een gepaste optie zijn voor jouw situatie.

De frequentie waarmee je btw-aangiftes moet doen kan ook per land verschillen. Over het algemeen hangt de manier van btw-aangifte af van de landen waaraan je verkoopt of producten opslaat.

Waar moet je rekening mee houden als je btw-aangifte doet als e-commerce ondernemer?

Samengevat hangt de manier van btw-aangifte af van de volgende factoren:

- of je bedrijf in een EU lidstaat is gevestigd;

- of de waarde van je afstandsverkopen hoger is dan de drempelwaarde van 10.000;

- of je aan verschillende EU landen verkoopt;

- of je lokale registraties (nodig) hebt.

Als e-commerce verkoper is het aannemelijk dat je producten op verschillende marktplaatsen verkoopt. Terwijl je onderneming groeit, groeien de administratieve lasten voor een volledige btw-compliance met je mee. Veel e-commerce verkopers maken daarom gebruik van automatische software voor hun btw-aangiftes. Het is echter wel van belang dat je er zeker van bent dat deze software ook geschikt is voor jouw specifieke situatie.

Kom je er toch niet uit? Onze Staxxers staan voor je klaar!

Zeker zijn dat je btw-aangifte goed verloopt?

Staxxer heeft als doel om een adequate software en service te bieden die aansluit op jouw situatie. Het design van de Staxxcloud software houdt rekening met de meest belangrijke aspecten als het gaat om volledige btw-compliance voor e-commerce ondernemers. Met een persoonlijke service in je eigen taal koestert Staxxer het menselijke aspect bij je btw-aangiftes.

Wil je snel en gepersonaliseerd je btw-aangiftes doen? Ook als je een boekhouder hebt: daar gaat Staxxer prima mee samen. Verken onze opties.